Often when we hear about wire fraud scams, the first that comes to mind is low-level email scams. No, you don’t have a distant relative who wants to bequeath you his vast fortune before he dies. You don’t have a wealthy tycoon who lost his passport while traveling and needs your help to get home. And, of course, no Nigerian prince will text you an email to ask to help you get money out of the country. But wire fraud attacks often play a role in more enormous financial crimes.

What Is Wire Fraud?

Wire Fraud is a general term that covers all types of fraud using telecommunications. It includes fraud online, over the phone, social media, etc. For example, fraudulent emails can encourage people to make money transfers to a fraudster. There are also less popular types of Wire Fraud means, such as phone calls and text messages.

Wire Fraud Elements

From a legal standpoint, U.S. Government Section 1343, “Elements of wire fraud,” states that prosecuting someone for wire fraud requires authorities to:

- Show that the perpetrator used a “scheme to defraud by pretenses.”

- Demonstrate the defendant’s “knowing and willful participation in the scheme to defraud.”

- Demonstrate “use of interstate wire communication in furtherance of the scheme.”

While the definitions and terminology of online and telephone fraud vary widely in other countries, the U.S. uses the general term wire fraud, a catch-all because the nature of the online world and global telephony inherently crosses state borders and boundaries. Unfortunately, enormous amounts of money are lost yearly due to wire fraud, affecting businesses and individuals. And because of the differences in statistic representation, it is almost impossible to get an overall global figure. Nevertheless, cybercrime (of which wire fraud is integral) is a growing problem.

History of Wire Fraud

Not so long ago, when the Internet was cleaner, scammers had to make hundreds of phone calls to snag a gullible retiree to carry out a scheme. Although this old-fashioned phone-call tactic is still used to contact a potential victim, today, with the enormous power of the Internet to search, a scammer can do his job online. All he needs to do is a few fake posts with pictures telling tales of woe or promises of eternal love – even if it’s all written with lousy spelling with a number of grammatical errors. If you receive such messages or requests to send $1,000 to a stranger, delete them immediately. Don’t fall prey to scammers.

Examples Of Wire Frauds

Since wire fraud is a broad term, there are almost endless examples. Today we will look at two of the most common, Nigerian prince fraud and money transfer fraud.

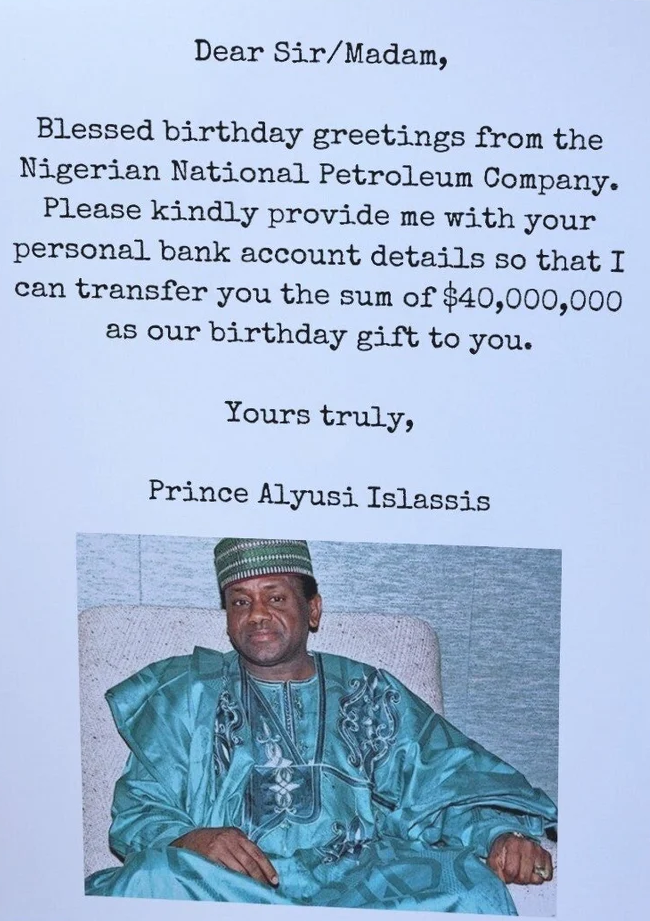

Nigerian prince fraud

The Nigerian Prince scam is perhaps the most common and one of the oldest examples of wire fraud. In this scam, the actor sends an email claiming to be a Nigerian prince who urgently needs help because he cannot access his bank account’s wealth. Apparently, “Nigerian” is optional – crooks may opt for Lybia, Namibia or other African country. It claims he needs you to hold his millions and promises to give you a substantial sum in return. The main goal of this scam is to get the victim’s financial information, which the scammer will use to access the victim’s money.

This scam has become a common noun, like SPAM.

Although this is one of the oldest Internet scams in history, some still fall for this scam or a variation of it. Whether you receive an email from a wealthy traveler or your long-lost cousin, do not wire money under any circumstances. Once you transfer cash (especially overseas), it cannot be traced, or the transaction reversed.

One of Nigerian princes was apprehended and charged on December 28, 2017. He turned out to be a 67-year-old man from Louisiana. When this scheme appeared in the 1980s, Americans lost millions of dollars to this scam. While this scam is evident to seasoned Internet users, it continues to this day. It is far from a small-scale operation and often involves organized crime. For example, in 2015, a victim of a scam from South Korea with a daughter was kidnapped after flying to Africa to receive a promised payout.

Bank Wire Transfer Frauds.

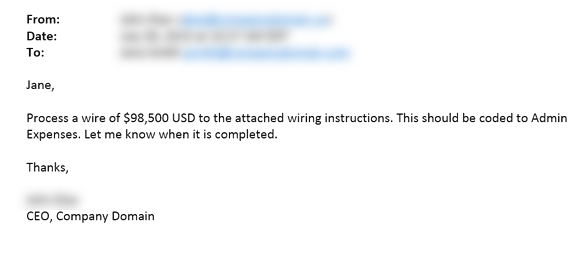

CEO fraud, or CEO email fraud, is a type of wire fraud that has already cost companies more than $26 billion. Unfortunately, cases of this fraud can grow by more than 100% yearly. This method is relatively simple to execute; the victims are company employees – usually in the finance department. They receive an “urgent” email, supposedly sent by the CEO or other high-ranking employee, ordering them to pay the bill immediately. If successful, the scammers may attempt this trick once again.

Bank Wire Transfer Fraud example

How to prevent wire fraud

Avoiding wire fraud primarily comes down to developing an awareness of fraud and cybercrime. Caution and healthy skepticism do well to help people every time they receive an unwanted phone call or email. To the experienced eye, the signs are often obvious:

- Strange, confusing email addresses.

- Phone calls from organizations the victim usually has nothing to do with.

- Suspicious login pages.

However, cybercriminals do not stand still and are constantly improving their methods, often coming up with cunning fraud schemes designed to convince even the most experienced Internet users. Therefore, it’s also essential to follow the basics of cybersecurity. Timely software updates, the use of complex, different passwords for each service, and properly configured security software, as well as extreme caution when working with unsecured wireless networks.